Introduction

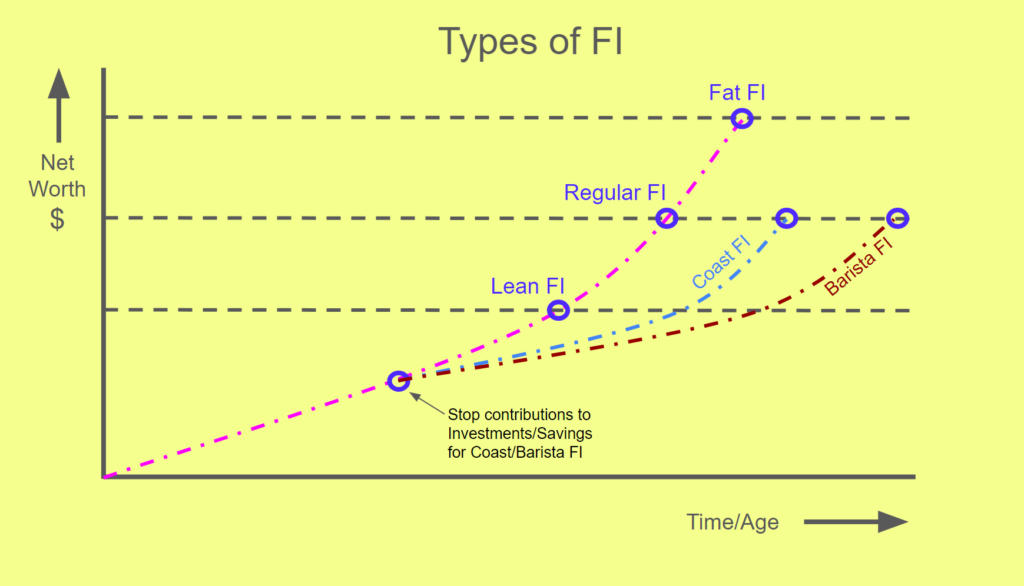

Financial Independence (FI) is a goal that we strive for here in this blog, allowing us to live life on our terms without being reliant on a traditional job. However, the path to achieving FI isn’t one-size-fits-all. There are various approaches, each suited to different lifestyles, goals, and financial situations. Whether you want to maintain a minimalist lifestyle or aim for a more luxurious life, there’s an FI strategy that can align with your vision. In this article, we’ll explore the most popular types of FI and how each one might fit into your financial journey.

1. Regular (traditional) FI

This is the standard approach to reaching Financial Independence where you are aiming to fully retire earlier than the conventional retirement age. Typically this assumes that you are retiring in your 40s or 50s with a sufficient FI number to sustain your lifestyle.

This method relies on passive income from investments and savings to cover all living expenses. You will start by calculating your current expenses accurately and based on your best estimate and life goals come up with an annual expense during retirement. Then apply the 4% rule to calculate your FI number, which assumes you can safely withdraw 4% of your investment portfolio annually without running out of money. For example, if someone wants to spend $50,000 per year, they would aim to accumulate $1.25 million (based on the 4% rule).

2. Lean FI

Lean FI is regular FI but with a ‘lean’ or ‘frugal’ lifestyle. This typically refers to reaching financial independence with a relatively modest lifestyle. This approach involves keeping living expenses low and needing a smaller amount of savings or investments to sustain financial independence. Lean FI practitioners often live frugally, focusing on cutting expenses and adhering to a minimalist lifestyle.

Lean FI requires a lower FI number and emphasizes on reducing expenses to achieve FI faster. The idea is that if you are able to live a simpler lifestyle with fewer luxuries then you will be ‘Free’ faster and have more time and independence in life. For example, someone who plans to live on $30,000 per year might target a FIRE number of $750,000 (based on the 4% rule).

3. Fat FI

Fat FI is the opposite of Lean FI where you want to achieve financial independence but also wish to maintain or elevate to a more luxurious lifestyle. This approach requires a larger nest egg to fund a higher standard of living, allowing for more discretionary spending without needing to worry about running out of money.

This would require a higher FI number due to a higher cost of living. This approach is suitable for those who want to continue enjoying travel, dining, or other luxury expenses. This in turn does take longer to achieve compared to Lean FIRE due to the need for more savings. For example, someone aiming for Fat FIRE may want to spend $100,000 per year, requiring a nest egg of $2.5 million (again using the 4% rule).

4. Barista FI

Barista FIRE is for those who reach partial financial independence and want to supplement their income with part-time or lower-stress work. The idea is to cover some of your living expenses through work (which may or may not offer benefits) while withdrawing less from your investments until full FI is achieved.

In Barista FI you combine income from a part-time or a ‘chill’ job with passive income from your investments to sustain your lifestyle. This can be helpful if you want to reduce the chances of burn-out from a stressful job by allowing you some flexibility in the type of job you choose. You may even be eligible for employer benefits such as health insurance through part-time work. For example, a person might accumulate enough savings to cover 50% of their living expenses from investments and work part-time to cover the rest.

5. Coast FI

Coast FIRE refers to achieving financial independence where your investments are large enough that, with time and compound interest, they will eventually grow to sustain your retirement without the need for additional contributions. The key here is to “coast” to retirement by no longer needing to save aggressively, though you may still work for income to cover current expenses.

In Coast FI you grow your investments to a large enough amount that, with no further additions, it will grow to a sizable nest egg by traditional retirement age. This allows for you to not have to save aggressively and have flexibility in your working years. For example, a person in their 30s might reach Coast FIRE by accumulating $300,000, knowing that with 20-30 years of growth, this amount will grow enough for retirement.

6. Flamingo FI

Flamingo FI is a type of Coast FI where you save until your investments reach 50% of your FI number. If we assume a long-term board market index fund return of around 7% then the rule of 72 will tell us that it takes roughly 10 years to double our money. So if you reach Coast FI with 50% of your nest egg target saved then you need to Coast for about 10 years.

This hybrid model allows you to have built a sizable nestegg early so that you can then switch to flexible, low-stress work and still retire much earlier than the traditional retirement age.

Conclusion

The different types of FI presented here (and there may be many more variations) are simply categorizations that help you understand that you have choices. Each type of FI depends on your personal goals, risk tolerance, lifestyle preferences, and timeline, offering flexibility in how you achieve financial independence. You don’t have to stick with one approach for your entire journey—pick the one that suits your current lifestyle. You may even switch strategies over time, perhaps taking a career break in between, or trying Coast FI or Barista FI for a while. Your goals and life situation will change, and you will likely adjust your FI number several times along the way.