When it comes to building financial stability, few things are as essential as having an emergency fund. Think of it as the financial cushion that supports your entire personal finance plan. By giving you something to fall back on in difficult times, an emergency fund not only protects you but also gives you peace of mind, allowing you to focus on other financial goals, like saving and investing.

Let’s explore why an emergency fund is so crucial, how much you need, where to keep it, and the ways it can empower your financial journey.

Why an Emergency Fund is Essential

An emergency fund is one of the most important financial tools you can have, serving as a protective backbone that ensures you’re prepared for life’s uncertainties. Financial setbacks can happen unexpectedly: a sudden job loss, an unexpected medical emergency, a fender bender, an urgent home repair. Without an emergency fund, these situations can lead to debt, stress, or a need to dip into your long-term investments.

Having an emergency fund in place provides a sense of security and confidence. It’s the warm, fuzzy feeling in your belly that tells you, “No matter what happens, I have a safety net.” Knowing you have funds set aside allows you to make calm, clear-headed decisions during times of crisis, rather than reacting out of fear or scarcity.

How Much Should You Have in an Emergency Fund?

A good rule of thumb is to keep 3-6 months’ worth of living expenses in your emergency fund. However, the exact amount will depend on your personal circumstances and the level of security you desire. Consider these factors when deciding how much to save:

- Job Stability: If you have a stable job with reliable income, you may feel comfortable with a 3-month emergency fund. However, if your job is unpredictable or you work in a volatile industry, a 6-month (or even 12-month) fund may be more appropriate.

- Health and Family Needs: If you have dependents or health issues, you may need more funds to cover unexpected medical expenses.

- Other Income Sources: Dual-income households or those with passive income streams may not need as large an emergency fund as those relying on a single income source.

When calculating your emergency fund target, focus on essential expenses like rent/mortgage, utilities, groceries, transportation, and insurance. This amount will provide you with a solid safety net, ensuring that your basic needs are covered.

Where to Keep Your Emergency Fund

The best place for an emergency fund is in a high-yield savings account that is FDIC-insured (in the U.S., this means it’s protected for up to $250,000 per depositor, per bank). Here are some key points to consider when choosing where to store your emergency fund:

- Accessibility: The fund should be easy to access quickly, so you’re not stuck in a tough situation. Avoid putting it in long-term investments or accounts with early withdrawal penalties, like CDs or retirement accounts.

- Liquidity: Cash in a high-yield savings account is liquid, meaning you can access it right away without needing to sell investments.

- Interest Rate: While the primary goal of an emergency fund is not to earn returns, keeping it in a high-yield savings account can still offer some growth, helping to counteract inflation.

It is important that you don’t invest your emergency fund in the stock market even though your money will not grow as much in the long term with the alternative. This is because the purpose of an emergency fund is not growth but rather security and peace of mind. A high-yield savings account provides a good balance of cash liquidity and a decent interest rate that will shield it inflation.

The Freedom of Having an Emergency Fund

Once you’ve built an emergency fund, you gain a sense of freedom and empowerment over your finances. Knowing you have a buffer for unexpected expenses allows you to focus your energy on other financial goals, like saving for retirement, building wealth through investments, or even pursuing personal goals like travel or education.

Without an emergency fund, even a minor financial hiccup can derail your plans. For instance, if you’re investing aggressively but have no cash reserve, a sudden expense might force you to sell your investments at an inconvenient time. Having a well-funded emergency account reduces the need to make drastic financial moves and lets you continue investing without interruption.

Building Your Emergency Fund: Tips to Get Started

If you don’t yet have an emergency fund, starting one can feel overwhelming. Here are a few tips to help you begin:

- Set a Target Amount: Use your essential monthly expenses to calculate a target of 3-6 months of expenses. Start with a smaller goal if needed (like $1,000) and build from there.

- Automate Savings: Set up automatic transfers to your savings account each payday. Automating the process makes saving easier and ensures consistent progress.

- Reallocate Small Windfalls: If you receive a tax refund, bonus, or other unexpected income, consider putting part or all of it toward your emergency fund.

- Cut Back Temporarily: Look for temporary ways to reduce non-essential expenses and redirect the savings to your fund. Even small amounts add up over time.

In Summary

An emergency fund is one of the most important components of a sound financial plan. It provides a safety net for unexpected events, offers a sense of control and peace of mind, and allows you to stay focused on your long-term financial goals. While building an emergency fund takes time, the security and freedom it provides are worth the effort. Start small, stay consistent, and give yourself the gift of financial resilience.

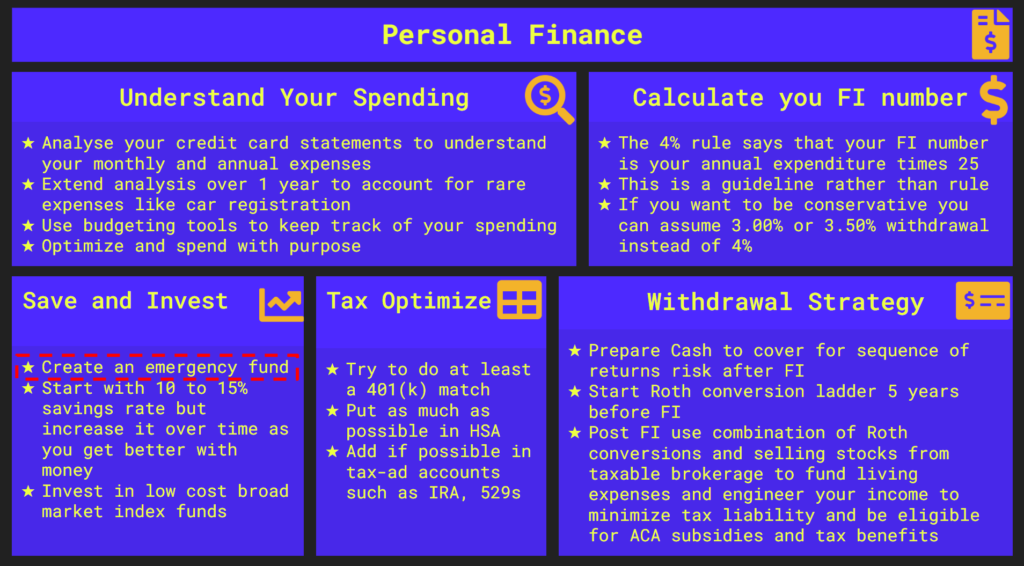

Pingback: How to calculate your FI number and what is the 4% Rule? – Financial Independence with Rohan