**This article is still a work in progress, you can skim over it but I recommend you hang on and come back in a few days**

Disclaimer: All of the information provided in this article is my personal opinion and is meant for entertainment and information purposes only. I am not a professional in the field but just a guy on the internet. Make sure you do your own research and consult with a professional such as a financial planner or a CPA before making investment decisions.

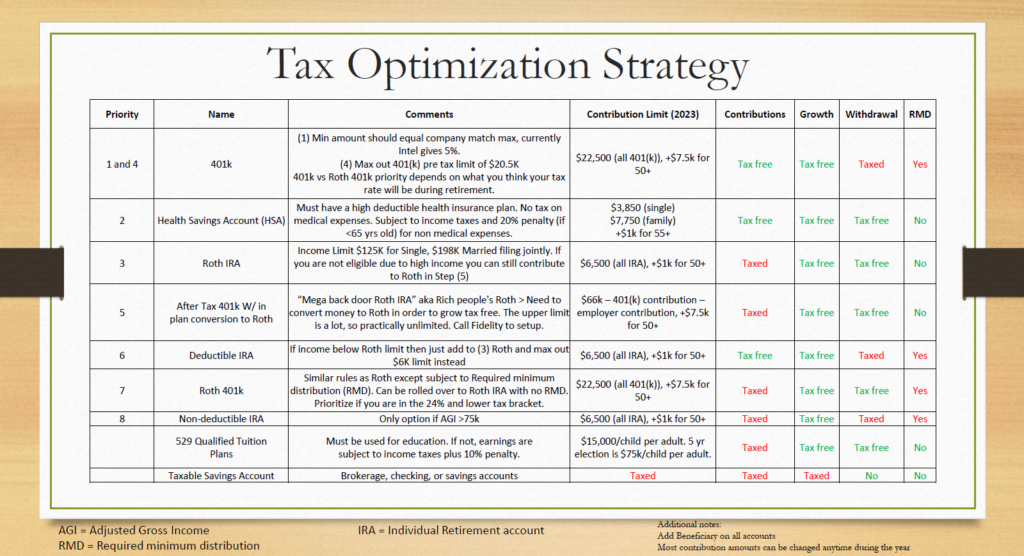

There are various types of tax-advantaged accounts that we have at our disposal. These are like tools in our toolbox, we should learn to use the correct tool in the correct manner to make the best out of it. These could help us with reducing our tax liability and reaching our FI goal sooner.

What is a tax-advantaged account and what is an IRA?

A tax-advantaged account is a financial account that offers certain tax benefits to encourage individuals to save or invest for specific purposes, such as retirement, education, or healthcare. These accounts are designed to reduce the tax burden on the account holder, either by deferring taxes, allowing for tax-free growth, or providing immediate tax deductions on contributions. Such an account provides some kind of tax-advantage but comes with certain conditions. We need to understand what those conditions are for the various types of accounts available so we can use it for the right purpose. Note that these are account types and not investments themselves, within those accounts you may be allowed to invest in the market and various other securities. An IRA or individual retirement account is one type of tax-advantaged savings account designed to help individuals save for retirement.

Traditional IRA

A traditional IRA is a tax-advantaged retirement savings account that allows individuals to contribute ‘pre-tax’ income that grows tax-deferred until withdrawal. Typically the money contributed to such an account can be deducted from the income used for calculating the taxes. Another way of saying this is that the money goes to a traditional IRA before any taxes are applied to it hence the term ‘pre-tax’. Within this account the money can be invested in various assets such as in an index fund and all the interest, profits or capital gains that happen are shielded from any taxes as long as the money stays inside this account. In other words the growth is tax-free. You, however, eventually have to pay taxes on this income but this is pushed or deferred to the future when you withdraw from this account, hence this is also known as a ‘tax-deferred’ account. When you take withdrawals from this account the money that comes out is considered ‘ordinary income’ hence this is subject to ordinary income tax, as opposed to capital gains tax. We will come back to this point later but just remember that there is a difference between those two tax rates.

For 2024 you are allowed to contribute a maximum of $6,500 or $7,500 if you are age 50 or older. You can only withdraw money from this account without penalty after the age of 59 ½ , any withdrawals before that age are subject to a 10% penalty in addition to ordinary income taxes. You are also required to start withdrawing money from this account at a certain age, known as the required minimum distributions (RMDs), right now this is set to 73. This rule exists because the government eventually wants that tax revenue. Anyone who has an ordinary income is allowed to open and contribute to a traditional IRA, most major brokerage companies offer this service. A traditional IRA helps you reduce your taxable income today but you still have to pay the taxes later. It makes sense to invest in this account if you expect that your income will be lower in retirement. If we think about what retirement means, in general we want to prepare for a situation where we may have a low or no income, so a traditional IRA does have an important role to play in our portfolio of account types.

Roth IRA

Roth is another type of tax-advantaged retirement savings account where contributions are made with ‘after-tax’ dollars but the growth and withdrawals are completely tax-free. For this type of account you pay all the taxes today, hence the ‘after-tax’ label, however once the money goes in you never have to pay taxes on any of the growth that happens within the account and the withdrawals are also completely tax free. A Roth makes sense if your current income is low and you expect to have a higher income in your retirement account. While this scenario is harder to imagine but due to it having tax free growth and withdrawals it is one of the best types of account to have for use in the latter part of your life.

The annual contribution limit for a Roth IRA is the same as traditional which for 2024 is $6,500 or $7,500 for those age 50 or older. You can in fact have both a traditional and Roth account however the total contributions for both of these accounts added cannot exceed the annual contribution limit of $6,500 or $7,500 for those age 50 or older. A Roth IRA is more versatile than a traditional IRA because although you cannot withdraw the growth from this account until the age of 59 ½ you can withdraw the principal amount (or the amount you have contributed to this account) anytime tax penalty free. The gains if withdrawn before 59 ½ have a penalty of 10%. There are some nuances however regarding this. Money can also be added to a Roth account by transferring money from a traditional IRA to a Roth IRA. This is known as a ‘conversion’ and is a taxable event where the conversion amount adds to your ordinary income for that year. The principal amount in a Roth IRA that comes from conversion also has a 5-year waiting period before a penalty free withdrawal unlike regular Roth contributions.

Since the taxes on Roth are paid upfront and there is no tax revenue that the government can generate from any withdrawals, there is no required minimum distribution (RMD) age. A Roth IRA with its many advantages is designed to help lower income individuals since the eligibility to contribute to a Roth IRA is based on your Modified Adjusted Gross Income (MAGI). In 2024, single filers with a MAGI of $153,000 or more, and married couples filing jointly with a MAGI of $228,000 or more, are not eligible to contribute to a Roth IRA. For higher income individuals there are some methods to get money into a Roth IRA, one that I mentioned earlier is a ‘conversion’ from a traditional IRA to Roth IRA. This is known as a ‘backdoor’ IRA and is a strategy that allows high-income individuals to contribute to a Roth IRA even if they exceed the income limits that normally restrict direct contributions.

After-Tax IRA

As I mentioned above for a Pre-tax account the money goes in tax-free, grows tax-free while the withdrawals are taxed, for a Roth the money goes in after tax is paid while the growth and withdrawals are tax free. In an after-tax IRA the money goes in after tax, the growth is tax-free but the gains are taxed during withdrawal. It’s usually better to put money in a Roth than an after-tax account if there is an option since with a Roth you only pay tax once and there is no need to pay taxes on the gains. An after-tax account might make sense if you are not eligible to put money in a Roth for example due to having a higher income, but you still want to get some tax-advantage.

401(k)

A 401(k) account is a tax-advantaged, employer-sponsored retirement savings plan that allows employees to save and invest a portion of their paycheck. Every job or employer does not offer a 401(k) but if this is offered there are quite a lot of advantages. One of the advantages of having a 401(k) is that it is considered a separate account from individual retirement accounts or IRA, there are separate limits for a 401(k) account. This means that you can contribute to both your IRAs and 401(k) if you have access to it. A 401(k) account is very versatile and depending on what level of benefits are offered by your employer sponsored plan it may have many types of accounts within it. Most employers offer a 401(k) with Pre-tax benefits which works just like a Pre-tax IRA, this will allow you to contribute Pre-tax money and reduce your tax liability for the current year. The limits for the Pre-tax portion of 401(k) is quite large, for 2024 this is about $23,000. If you’re age 50 or older, you’re eligible for an additional $7,500 in catch-up contributions, raising your employee contribution limit to $30,000. Instead of Pre-tax, you may also have the option to put money in a Roth 401(k), however this takes away the contribution amount from the Pre-Tax bucket. Most employers also offer a 401(k) match which means that the employer matches and contributes some money in your account depending on your contribution level to encourage the employee to save for retirement. For example, an employer may offer to match up to 3% if you contribute 3% of more of your base salary. This is basically free money and everyone should certainly contribute this as a minimum to take advantage of this benefit.

If you are able to contribute more however you can take advantage of the big contribution limit for Pre-tax dollars. If you ‘max out’ your 401(k) Pre tax bucket meaning you contribute the full $23,000 for 2024 and you want to contribute even more, you are allowed to do so but any additional money goes into the 401(k) as after-tax contributions. Just as a ‘backdoor’ IRA allows high income individuals to put money in a Roth by doing a ‘conversion’ from Traditional to Roth IRA, you can do something called Megabackdoor Roth conversion in a 401(k) using the after-tax money. Basically, if your employer plan allows it, you can convert any after-tax money that you contribute to your 401(k), after maxing out the Pre-tax bucket, to a Roth. This opens up a great option for high income individuals to put money in a Roth-type account even if they are not eligible to contribute to a Roth IRA directly. There is a limit for all the contributions to a 401(k) which include your Pre-Tax contribution, employer match and after-tax (which may be converted to a Roth using Mega Backdoor) and that is $69,000 for 2024. This I think is quite a high limit and allows you to put a huge amount in both Pre-tax and Roth type accounts, if your budget allows it.

The tax treatment for Pre-tax, Roth and after-tax within 401(k) are exactly the same as those in an IRA. So for the Pre-tax bucket the money goes in before you pay taxes, the growth is tax-free and the withdrawals are taxed as ordinary income. The money in the Roth 401(k) goes in after-tax, the subsequent growth and withdrawals are completely tax free. The principal amount can be withdrawn penalty free anytime. The Mega Backdoor is a bit nuanced, the money that goes in the after-tax bucket goes in ‘after-tax’ of course but it may accrue some interest or gains until it is converted to a Roth, this gain is taxed. Once it converts to Roth however it behaves just like a Roth account. You may be able to automate this Mega Backdoor ‘conversion’ step and convert any After-tax money to Roth as soon as it is deposited. Talk to your 401(k) provider or HR to understand if this is possible to do. Automation will make things much simpler to manage and you don’t have to worry about the conversions. Since the money in the account comes from a ‘conversion’ you have to wait 5 years before you can withdraw the principal amount. The money in the Pre-tax bucket and the gains in the Roth cannot be accessed without a 10% penalty fee before the age of 59 ½.

The 401(k) is an extremely versatile account since it has multiple buckets within it that are equivalent to every type of IRA but with much higher contribution limits. The limits are also separate so you are able to have IRAs in addition to a 401(k). In most cases the contributions can easily be automated with automatic deductions from your salary. This combined with automatic investments means that once you set it up you can pretty much forget about it and your money is saved and invested for your future. You only need to check your 401(k) contributions once a year or when you have a salary increment. This one account may be able to satisfy all your savings and investment needs.

One of the problems however with a 401(k) account is the options for investment are sometimes limited. You are typically offered a limited number of investment options like a few Target Date funds, some mutual funds and maybe some index fund like option. When you start your job and get a 401(k) account you may not be aware of what your money is getting invested in. It is your responsibility to educate yourself on how to login and check for where your money is getting invested. Typically your money is selected to get invested in some Target Date fund. While Target Date funds are not bad, they often come with a high expense ratio and mediocre returns. Make sure you learn how to find the expense ratio for the various funds offered in your 401(k) plan. My recommendation is to find and invest in a fund that is most similar to a broad market Index fund such as S&P 500 index fund equivalent.

<401(k) Screenshot of fund list and expense ratio.>

403(b) and 457 Accounts

A 403(b) account is a tax-advantaged retirement savings plan available to employees of public schools, certain non-profit organizations, and some religious institutions. It operates similarly to a 401(k) plan but is designed specifically for employees in these sectors. Employees can contribute a portion of their salary to a 403(b) account on a pre-tax basis, reducing their taxable income in the year of contribution. The contributions and any investment earnings grow tax-deferred until withdrawn in retirement. For 2024, the maximum contribution limit for a 403(b) plan is $23,000 for those under 50, with an additional $7,500 catch-up contribution allowed for those aged 50 and older. Some 403(b) plans offer a Roth option, allowing employees to contribute after-tax dollars, with the potential for tax-free withdrawals in retirement, provided certain conditions are met. Withdrawals in retirement are taxed as ordinary income. Early withdrawals before age 59½ are typically subject to a 10% penalty and just like other tax-deferred retirement accounts, RMDs must begin at age 73.

A 457(b) account is a tax-advantaged retirement savings plan available to employees of state and local governments, as well as certain non-profit organizations. It is similar to a 401(k) or 403(b) plan but has unique features, particularly in how and when withdrawals can be made. For 2024, the maximum contribution limit for a 457(b) plan is $23,000 for those under 50, with an additional $7,500 catch-up contribution allowed for those aged 50 and older. 457(b) plans offer a unique “double catch-up” provision, allowing employees close to retirement age (within three years of normal retirement age) to contribute up to twice the annual limit, potentially catching up on years when they didn’t contribute as much. Some 457(b) plans offer a Roth option, allowing for after-tax contributions and tax-free withdrawals in retirement, provided certain conditions are met. Unlike 401(k) and 403(b) plans, 457(b) plans do not impose a 10% penalty for early withdrawals before age 59½, making them more flexible for early retirement or unexpected needs. Withdrawals are taxed as ordinary income. Because there is no early withdrawal penalty, 457(b) plans can be more flexible for those retiring early or needing access to funds before 59½. RMDs must begin at age 73, similar to other retirement plans.

Both 403(b) and 457(b) accounts provide valuable retirement savings options with tax advantages, but each has specific features that may make one more suitable than the other depending on your employment situation and retirement goals.

Health Savings Account (HSA)

A Health Savings Account (HSA) is a tax-advantaged savings account specifically designed for individuals who are enrolled in high-deductible health plans (HDHPs); it allows them to set aside money on a pre-tax basis to pay for qualified medical expenses, which not only includes routine doctor visits, prescriptions, and medical procedures, but also extends to a wide range of healthcare costs such as dental and vision care. The beauty of an HSA lies in its triple tax advantage: contributions are tax-deductible (or pre-tax if made through payroll deductions), the funds grow tax-free over time as they can be invested in a variety of vehicles similar to an IRA, and withdrawals for qualified medical expenses are also tax-free, which collectively makes it one of the most tax-efficient accounts available.

HSAs are incredibly versatile because they do not have a “use-it-or-lose-it” feature, meaning the funds roll over from year to year, allowing individuals to accumulate significant savings that can be used well into retirement; moreover, unlike Flexible Spending Accounts (FSAs), which are also used for medical expenses but have a strict annual use-it-or-lose-it rule, the funds in an HSA can be carried over indefinitely, giving it a long-term savings potential that can complement other retirement accounts. This feature becomes especially advantageous when considering that after age 65, HSA funds can be withdrawn for any purpose without the 20% penalty that applies to non-medical withdrawals before this age; however, it’s important to note that non-medical withdrawals after age 65 are subject to ordinary income tax, which aligns them more closely with traditional IRAs in this regard.

Furthermore, eligibility for an HSA is contingent upon being enrolled in a high-deductible health plan, which, for the year 2024, is defined by the IRS as a plan with a minimum deductible of $1,600 for individual coverage or $3,200 for family coverage, with a maximum out-of-pocket expense of $8,050 for individuals and $16,100 for families; it’s also worth noting that the contribution limits for HSAs in 2024 are $4,150 for individual coverage and $8,300 for family coverage, with an additional $1,000 catch-up contribution allowed for individuals aged 55 and older. Because of these features, an HSA can serve not only as a method for covering current healthcare costs but also as a powerful tool for building a tax-efficient nest egg that can be used to cover healthcare expenses in retirement, which, given the rising costs of healthcare, can be a significant burden for retirees if not properly planned for.

I personally think that it makes sense to maximize the contributions to your HSA due its many benefits. Fidelity estimates that after the age of 65 the average medical cost is $157,500 for a single retiree, or $315,000 for a couple. I think the investments in an HSA can help cover a major part of medical expenses in these latter years.

529

A 529 account, also known as a 529 plan, is a tax-advantaged savings plan designed to encourage saving for future education costs. A 529 is similar to a Roth account but with some additional state tax benefits depending on the state, but the funds can only be used for qualified education expenses. The growth and withdrawals from a 529 account are also tax-free, provided they are used for qualified educational expenses, which include tuition, fees, books, supplies, and sometimes room and board. The funds can also be used for K-12 tuition (up to $10,000 per year) and certain apprenticeship programs. Recently, 529 plans have also been allowed to be used for student loan repayments, up to $10,000 per beneficiary. While there are no annual contribution limits set by the federal government, contributions to a 529 plan are subject to gift tax rules. For 2024, contributions up to $17,000 per year per individual (or $34,000 for a married couple) can be made without triggering federal gift taxes. Many states offer state tax deductions or credits for contributions to their own 529 plans, adding a layer of tax benefits for residents of those states.

One of the disadvantages of a 529 is that if it is overfunded and not needed for qualified educational expenses it may be difficult to get the money out. If funds from a 529 account are used for non-qualified expenses, the earnings portion of the withdrawal is subject to income tax and a 10% penalty. The principal (contributions) can be withdrawn tax- and penalty-free. Fortunately, recent legislative changes, as part of the SECURE Act 2.0, passed by Congress at the end of 2022 may put some of these concerns to rest, as distributions from 529 accounts can now be used to give the same beneficiaries a retirement boost as well. Under certain conditions, you can roll over tax- and penalty-free up to a lifetime limit of $35,000 in a 529 to a Roth IRA open by the 529 beneficiary for more than 15 years, subject to annual Roth IRA contribution limits.

As a resident of Arizona I did not find the state tax advantage very good hence I decided to not open a 529 for my child. I instead plan to fund his college using my Roth account.

Final Thoughts

Check the summary image at the top to get an idea for all the different types of accounts available and what are the tax-advantages, conditions and limitations. Remember that all the tax-advantaged accounts are just types of accounts with different tax treatments however they are not investments themselves. Within each account you need to make a choice of where you want your money to be invested. As you might have guessed my personal choice of investment is the same for all accounts and that is broad market index funds.