Imagine waking up each day knowing you have all the financial resources you need, robust health, ample time, and nurturing relationships. What would you do with your life? Would that be a good place to be?

Background

Time, health, and money are limited resources in life. Money is usually a resource we can easily quantify—your net worth can be expressed as an exact number. Time, however, is more elusive. While we may feel how much time we’ve spent or how much we have left, we don’t really know when our time will run out, so we tend to avoid thinking about it. This often results in us not valuing time as the finite resource it is. Health, too, is something we tend to gauge by how we feel, which makes it harder to accurately assess its limitations. As a result, for much of our lives, money becomes the primary focus of resource accumulation and optimization.

I don’t want money to be the limiting factor in life, but it’s important to recognize there is much more to life than money alone.

First, Let’s Talk Money

Money is many things. It influences our lives in numerous ways. It drives big decisions and can make or break relationships. Money has the power to change our lives. While some say it’s the root of all evil, it can also be a tool for good.

So, what does money mean to me? For me, it’s a means to sustain my family, provide us with a home, allow us to travel, and enjoy the many opportunities the modern world offers. But beyond that, it provides safety and security, which, in turn, brings stability and peace. Having money allows us to live without the constant worry of job loss or emergency expenses. A stable source of income, combined with solid financial planning, forms the foundation of a well-functioning life.

However, if money becomes the goal, rather than a means to an end, it can compromise our happiness and fulfillment. Money is just a tool; it’s not the destination. Accumulating wealth for its own sake is not a good strategy, as life is not a contest to see who can amass the largest pile of money. The bigger question is: What do you really want? What is your ultimate goal? What gives your life meaning? It’s not just about the end result but also about how you want the journey to unfold, because the journey is where life happens.

What is FIRE or FI?

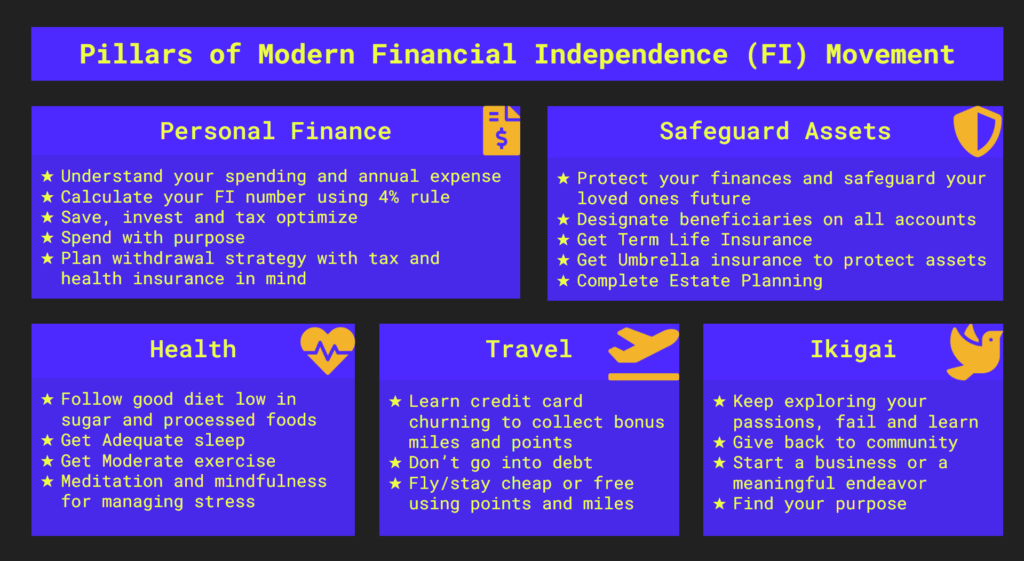

FIRE stands for Financial Independence, Retire Early. This movement has emerged as an alternative to the traditional retirement path, where the retirement age is typically 60 or 65. Over time, the emphasis has increasingly shifted toward the Financial Independence (FI) part of the acronym.

You are considered financially independent when the passive income from your assets, such as investments, is enough to cover your living expenses. In other words, you no longer need to earn an active income from a job to pay for your lifestyle, freeing you from being dependent on a paycheck.

Why FI?

Reaching Financial Independence doesn’t necessarily mean you have to retire early, but it does make working optional. As a result, there’s less focus on the Retire Early (RE) part of FIRE. Retiring early appeals to those who feel burned out or unfulfilled in their work life. While the prospect of retiring early may be what first draws you to the FIRE movement, it’s the financial independence part where all the magic happens. In my personal opinion everyone should pursue FI but the RE part is optional.

Becoming FI can have massive implications for your life, especially if you achieve it early. Leaving your job at this point allows you to reclaim a large chunk of your time. You can then use that time to focus on things that matter more—spending quality time with your family, traveling, working on personal projects that bring fulfillment, or even starting a business.

One of the most compelling aspects of FI is the freedom of choice it provides. When you are financially independent, you are not bound to a job just for the sake of a paycheck. This means you can choose work that aligns with your passions, volunteer for causes you care about, or even take a break when needed without worrying about finances. FI allows you to design your own life. Whether you want to travel the world, spend more time with your family, or explore hobbies and interests, FI gives you the flexibility to do so. This sense of autonomy and control is incredibly liberating and makes the journey toward FI worth the effort.

Financial Independence provides a significant sense of security. Knowing that you have enough savings and investments to support yourself means you are less vulnerable to unexpected life events like job loss, medical emergencies, or economic downturns. It means no longer living paycheck to paycheck or feeling anxious about bills and expenses. Instead, you can focus on the things that truly matter, like your relationships, health, and personal growth, without constantly worrying about money. This peace of mind that comes with being financially prepared can greatly improve your overall quality of life and well-being.

One of the most valuable resources we have is time, and FI gives you more of it. By reaching FI, you can reclaim your time from a 9-to-5 job or the typical 40-hour workweek, which allows you to spend your time in more meaningful ways. FI isn’t just about not working—it’s about choosing how you want to spend your time and investing it in activities that bring you fulfillment. FI empowers you to spend your energy on things that bring joy and meaning to your life rather than just what pays the bills.

That said, achieving FI doesn’t guarantee happiness or the resolution of all your problems. You won’t suddenly become healthy, nor will all your relationship issues vanish. Challenges will always exist. However, the freedom of time that comes with FI gives you the ability to focus your energy on the things that truly matter. Many people find that the journey to FI brings them a greater appreciation for simplicity and the things that truly bring happiness, rather than the constant pursuit of material goods. While life will never be completely problem-free, by addressing the big issues, you can have better problems to tackle and allocate your energy accordingly. FI is not just about reaching a number in your bank account; it’s about developing good habits, like budgeting, investing wisely, and living intentionally. These habits not only help you reach FI but also make you more resilient and adaptable to life’s changes.

What Is It All For?

The excitement of the FI journey lies in the transformation you experience along the way. It’s not just about the end goal but about the process of becoming more empowered and intentional with your life and finances. Watching your savings grow, seeing your debt decrease, and knowing that every month you’re getting closer to your goal is deeply satisfying. Learning about investing, budgeting, and how money works can be empowering. The more you know, the more confident you become in making decisions that affect your financial future.

The FI community is a vibrant and supportive space where people share their stories, tips, and motivation. Connecting with like-minded individuals who have similar goals can make the journey feel less daunting and more inspiring. The journey to FI has many milestones, from paying off debt to hitting your first $100,000 or $500,000 in investments. Celebrating these achievements makes the process rewarding and keeps you motivated to keep going.

Achieving FI is like adding a valuable tool to your life, making money—a limited resource—a non-issue. This financial freedom opens up options for how you spend your time. Having money, good health, plenty of time, and nurturing relationships are the pillars of a happy and holistic life. Ultimately, it comes down to happiness. Eastern philosophies emphasize that happiness is not derived from external factors but is, instead, a state of mind. Theoretically, you have the ability to be happy in any situation. In practice, though, you need to figure out what makes you happy, what gives your life meaning, and what brings you purpose. Pursuing FI may be a step in the right direction.

Financial Independence is not just about accumulating wealth; it’s about creating freedom, security, and the ability to live life on your own terms. It’s an exciting journey because it empowers you to take control of your financial destiny, provides the time and freedom to pursue your passions, and gives you peace of mind knowing you are prepared for whatever life brings. Ultimately, it’s about building a life that aligns with your values, where you have the time, energy, and resources to focus on what truly matters to you.